Effortless Personal Finance Management with QIK

Welcome to QIK! This free-to-use application is designed to help you manage your finances with ease, speed, and style. QIK focuses on quick interaction and high performance while providing a beautifully designed user experience.

Try it out at https://qik-finance.com

TIMELINE

Aug 2024 - Dec 2024

ROLE

Sole Designer

THE SITUATION

It's no secret that young people entering the workforce often face irregular income patterns, new recurring bills, and little experience in tracking their spending. Existing finance web‑apps overload them with features or bury core functionality behind lengthy workflows.

I set out to build a free, web‑first finance tool for anyone who wants to take control of their money in seconds. I spoke with over 30 individuals to collect their thoughts and feelings on the subject. The insights crystallized into two groups:the Careful and the Carefree, and the mission became clear: create a better alternative to the market’s slow, cumbersome offerings.

QIK is a web‑first solution, backed by a mobile‑responsive quick‑log view that lets users record transactions in just 2–3 clicks and instantly see where their money stands.

THE CHALLENGES

- Clunky Entry Flows

Most finance apps force 5–7 inputs just to log one expense, killing momentum and motivation. - Visualizations

Charts and tables are often buried behind menus or static, making patterns hard to spot. - Expectations

Many users asked for bank‑sync auto‑logging, but linking accounts was cost‑prohibitive for a free tool.

THE VISION

A no‑friction web app where everything one'd need is brought up without ask, and your dashboard springs to life with interactive stats, helping both the Careful and the Carefree build healthier habits, effortlessly.

“I would like more control with less effort.”

—QIK Early User

Designing the Experience

1. Research & Insights

- 30+ Interviews on random people I met that was willing to share, revealed frustration with multi‑step forms and buried, redundant insights.

- Affinity Mapping split users into the Careful (who crave depth) and the Carefree (who need speed).

- Competitive Audit showed average logging times of 10–20 seconds; my goal was sub‑4 seconds.

2. Defining the Scope

Focused on two core flows:

- Logger (Homescreen entry + instant stats)

- Summary (Quarterly & yearly trends)

Auto‑sync with banks was explicitly deprioritized to keep QIK free and fast.

3. Information Architecture

Nav simplified to:

- Quick‑Log

- Dashboard

- Summary

Each flow surfaces only the essentials for that moment—no extra taps.

4. UI Design

- Light toned, harmonic and easing: managing finances is stressful enough, so the goal was to go for a light tone, easy on the eyes, fresh and clean interface while still being able to contain all the informations and statistics needed. Pale Azure and Aquamarine were chosen as the primary and secondary branding colors to achieve this, with a touch of Lapiz Lazuli where contrast is needed, finished with slate-ish grays as the neutral to wrap everything together harmonically.

- A Reactive interface: being a fast, interactive experience is not just about the steps that users take but also about the feedback they receive on each interactions. Every changes and feedbacks, even loading states are carefully thought out to bring users a sense of control and satisfaction, and in the same time bring the interface to life.

- Performance and Page-load speed: the core of the challenges when trying to build a fast product, how fast does it actually load? For this I tried to minimalized all visual elements on the screen especially pictures, illustrating to SVGs any elements that needed to be added, even animations are done via SVGs and clip-path animation.

Final UI Flows & Screen Placeholders

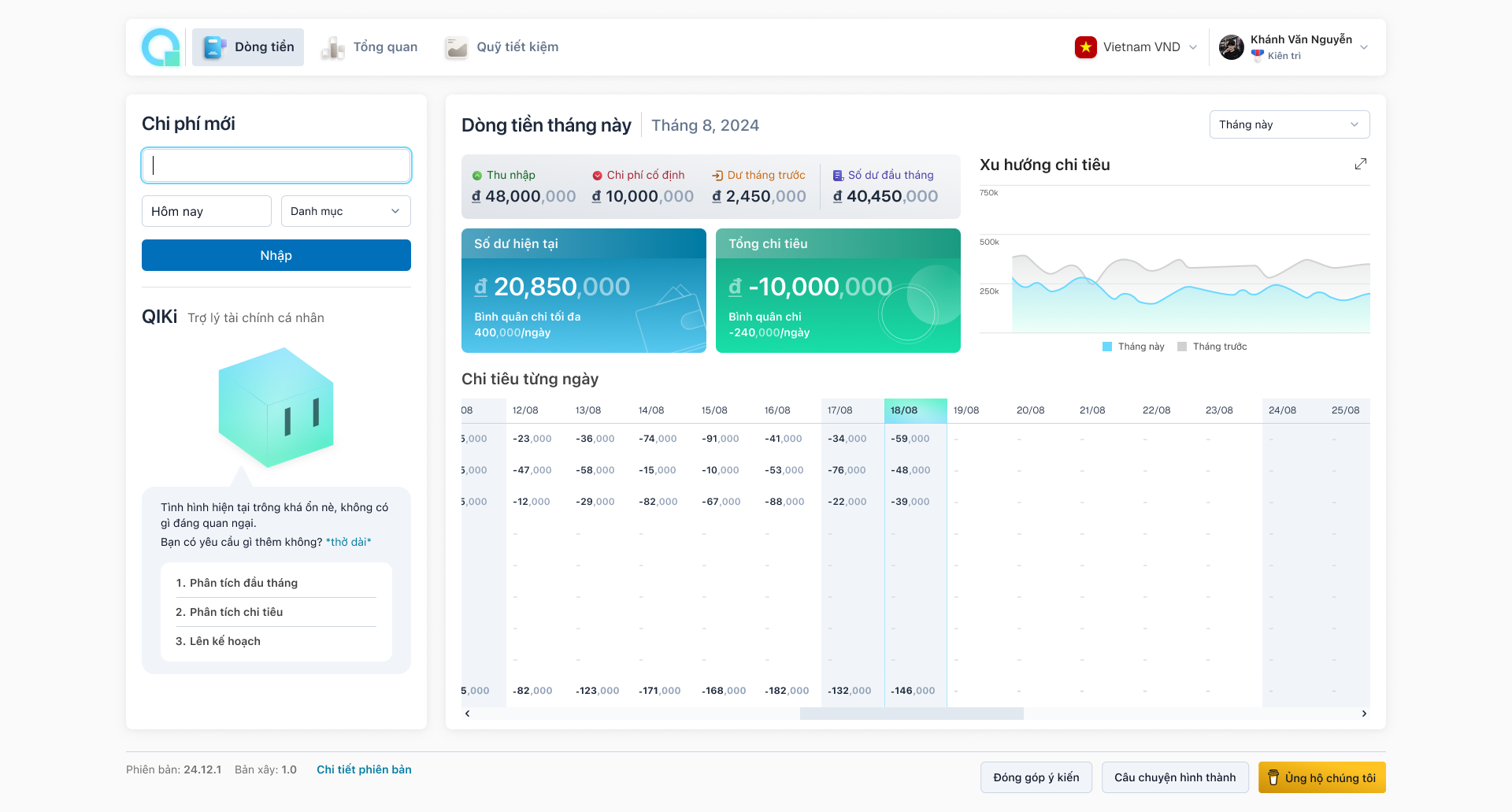

A. Logger (Homescreen)

- Auto focus amount field + pre-filled date to today + optional category

- Instant table + chart preview of daily spending

- Intuitive statistics and chart visualizations of spending habits

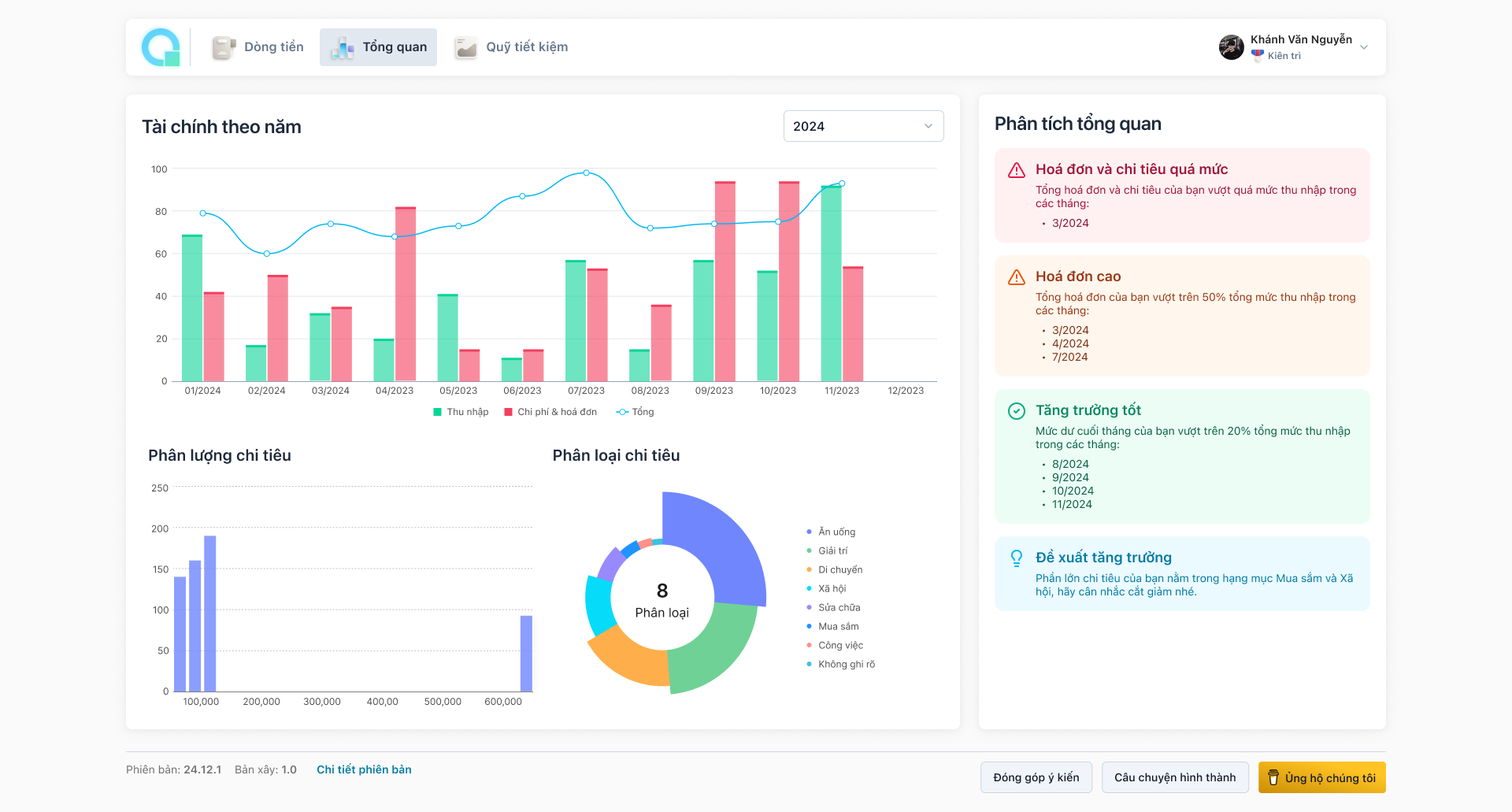

B. Summary (Trends View)

- Monthly overalls of the entire year

- Interactive graphs with hover‑to‑reveal values

- Analysis insights on spending and growth advises

Results & Outcomes

Post‑launch feedback and usage metrics showed:

- 🚀 72% reduction in average logging time (from 11 s → 3 s)

- 👍 30% reduction in “missed entries” compared to legacy spreadsheets

- 📈 85% daily active logging rate

- 🔍 52% of users clicked into data visualizations at least once per session

- 🚀 96 Performance Ratings by Lighthouse

“Thank you for making this.”

—Newly adopted user

Next Steps & Roadmap

- Tags AI: Smart categorization that learns user habits

- Shared Budgets: Collaborative features for friends and family

- PWA Optimizations: Offline logging and push reminders

- Accessibility Enhancements: Better keyboard & screen‑reader support

Try QIK Today!

Try it out at https://qik-finance.com and let me know what you think!